Share

By Angelo DiCaro

The past twelve months represented a positive step forward for working people in Canada. It was a period marked by low unemployment and high inflation (the conditions that typically create bargaining leverage for workers). It was also a period, on the heels of the COVID pandemic, when workers realized how integral their labour is to the health and success of the economy – and how, for years, that economy hasn’t delivered for them.

In 2023, Canada witnessed more frequent, and lengthier, labour disputes than at any point during the pandemic. The country also saw an increase in union membership along with record-setting wage and benefit improvements, including pension gains, across many sectors of the economy. Lana Payne, Unifor’s National President, in what became her trademark refrain, told the world that workers “are having a moment”. A moment, indeed. With all of this progress some have fittingly dubbed 2023 the Year of the Worker.

It’s hard to predict what 2024 has in store. Some doomsayers suggest wages have risen too high, risking higher inflation (this despite the clear disconnect between wages and price inflation in recent years). Others think workers have turned a corner, with more gains to be won especially as executive pay continues to soar, and corporations enjoy big profits. By all accounts, and barring a severe recession, 2024 should be another year of positive gains and growth for working people.

Here’s a look at 5 key trends that many trade unionists will be tracking over the new year.

#1: Economic growth is stalling, but is a recession inevitable?

In its quest to quash rising prices, the Bank of Canada undertook its most aggressive rate-hiking policy in modern history. This campaign drove up the cost of borrowing (e.g. on mortgage rates, car lease payments, etc.) and slowed Canada’s post-COVID economic recovery, threatening millions of jobs in the process.

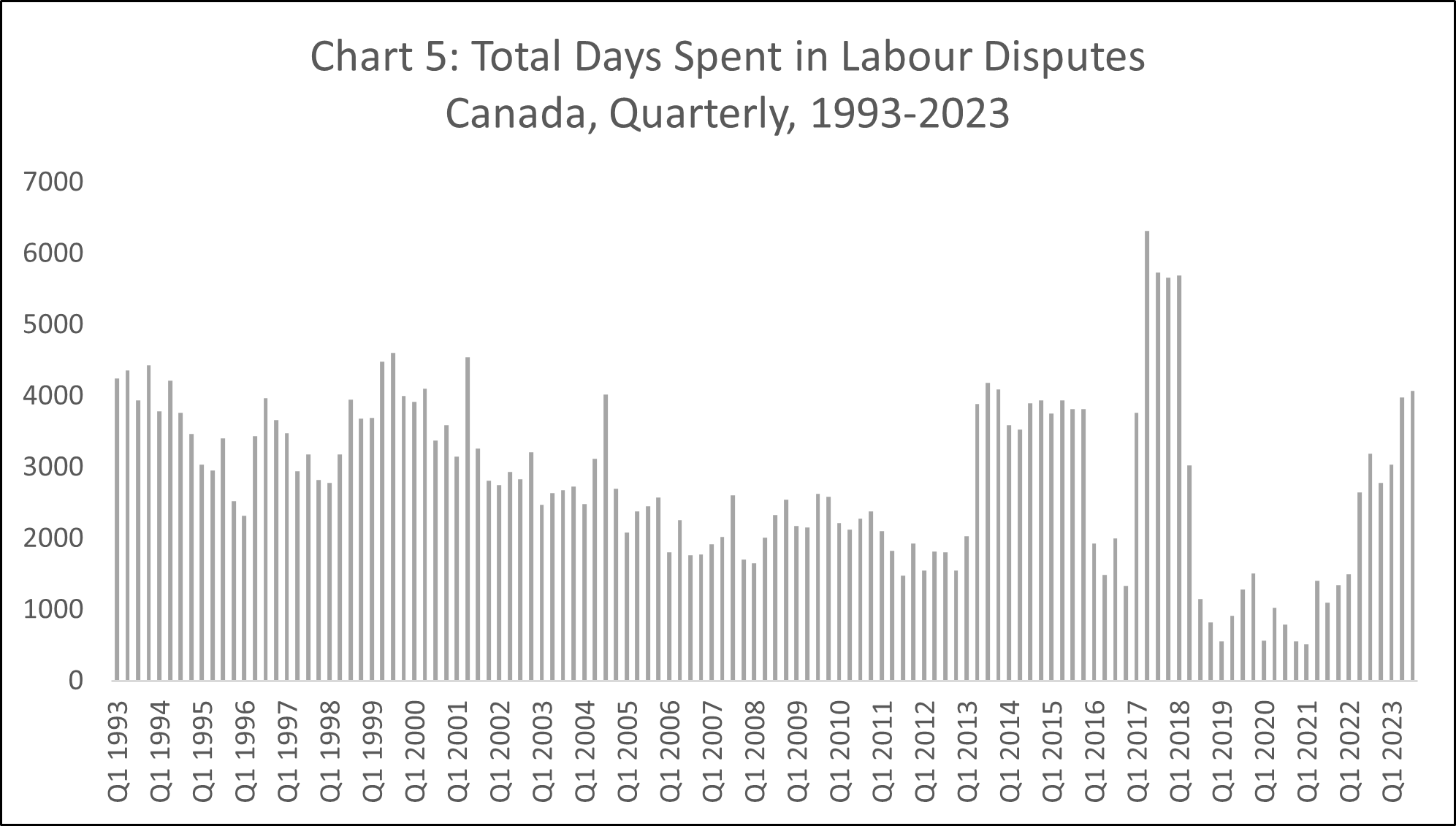

So far, and as predicted, economic growth has slowed (measured in Chart 1 by changes in Gross Domestic Product, or GDP - an indicator of total economic activity). Year-over-year quarterly GDP growth has fallen to post-COVID lows, and some economists suggest that a mild recession has already hit Canadian shores.

However, while the economy is softening, the job market remains vigilant – with unemployment holding relatively steady at 5.8% (as of December). Most analysts expect the Bank to reverse course and begin lowering interest rates at some point mid-year. This should relieve some anxiety that a severe recession is on the horizon. And overall tight labour market conditions bode well for workers seeking wage gains at the bargaining table throughout 2024.

#2: Wages are (finally) outpacing inflation, but is this trend sustainable?

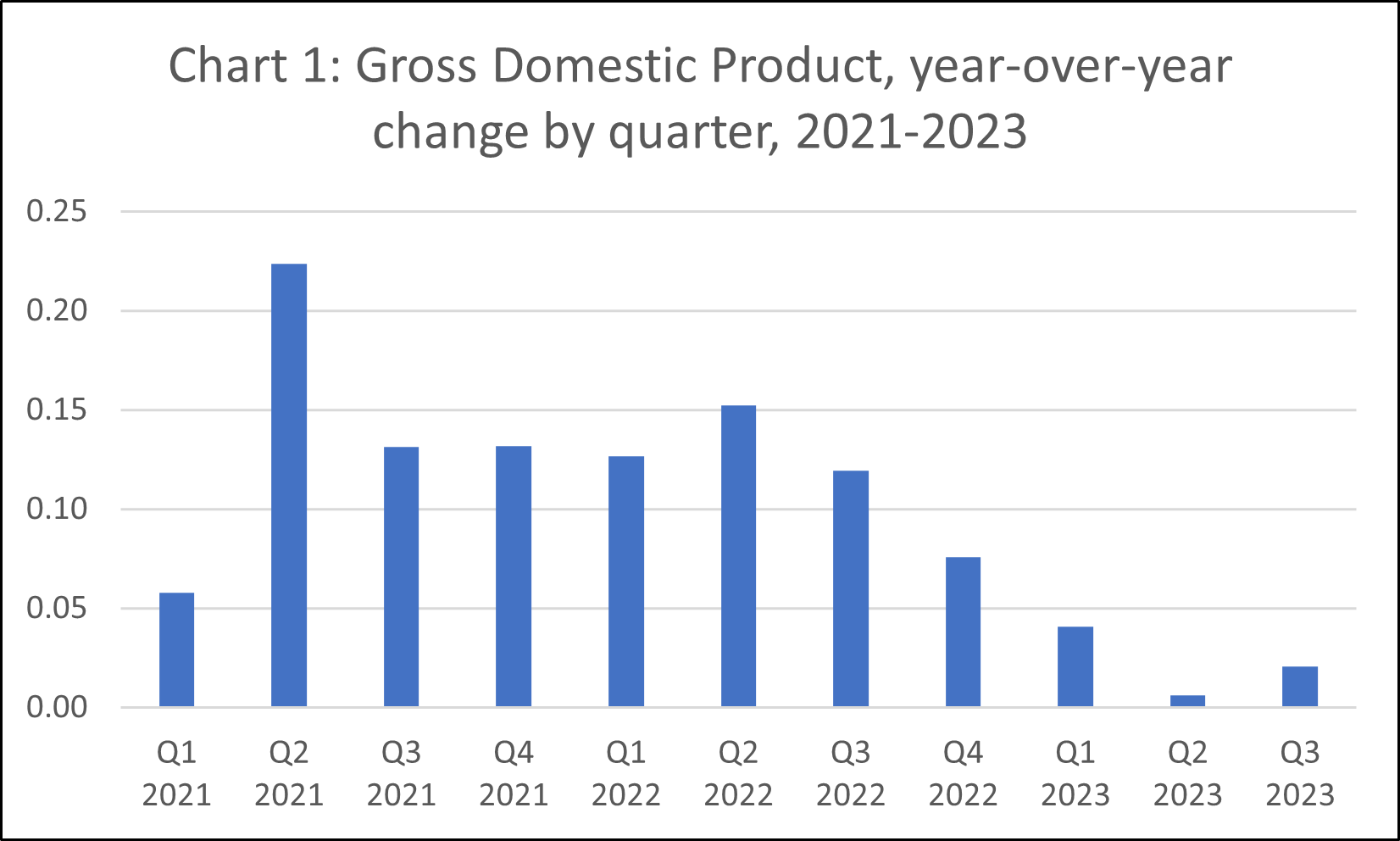

After COVID-era lockdowns ended, households got pounded by skyrocketing consumer prices, notably on food, fuel, and shelter – vestiges of the pandemic’s impact on supply chains and inventories. As prices rose, wages couldn’t keep pace (as Chart 1 illustrates), reducing the purchasing power of worker’s employment income, as Unifor documented in a 2022 report.

Thankfully, 2023 saw a reversal of this trend, in large part thanks to historic and standard-setting union contracts negotiated in various sectors, including health care, auto, energy, retail, transportation, and others. Year-over-year wage increases averaged 5% in 2024 – outpacing the rate of inflation over the year. With consumer prices growing at a slower clip (to be clear, prices haven’t fallen, they’re just not rising as fast), workers are poised to benefit. This, of course, is cold comfort to the rising number of working families who are currently struggling with the persistently high costs of food and rent, which warrants a strong and immediate government response.

Hundreds of thousands of union members will head to bargaining tables this year, with expectations to maintain – if not exceed – the wage gains made in 2023.

#3: Will productivity-boosting investments continue?

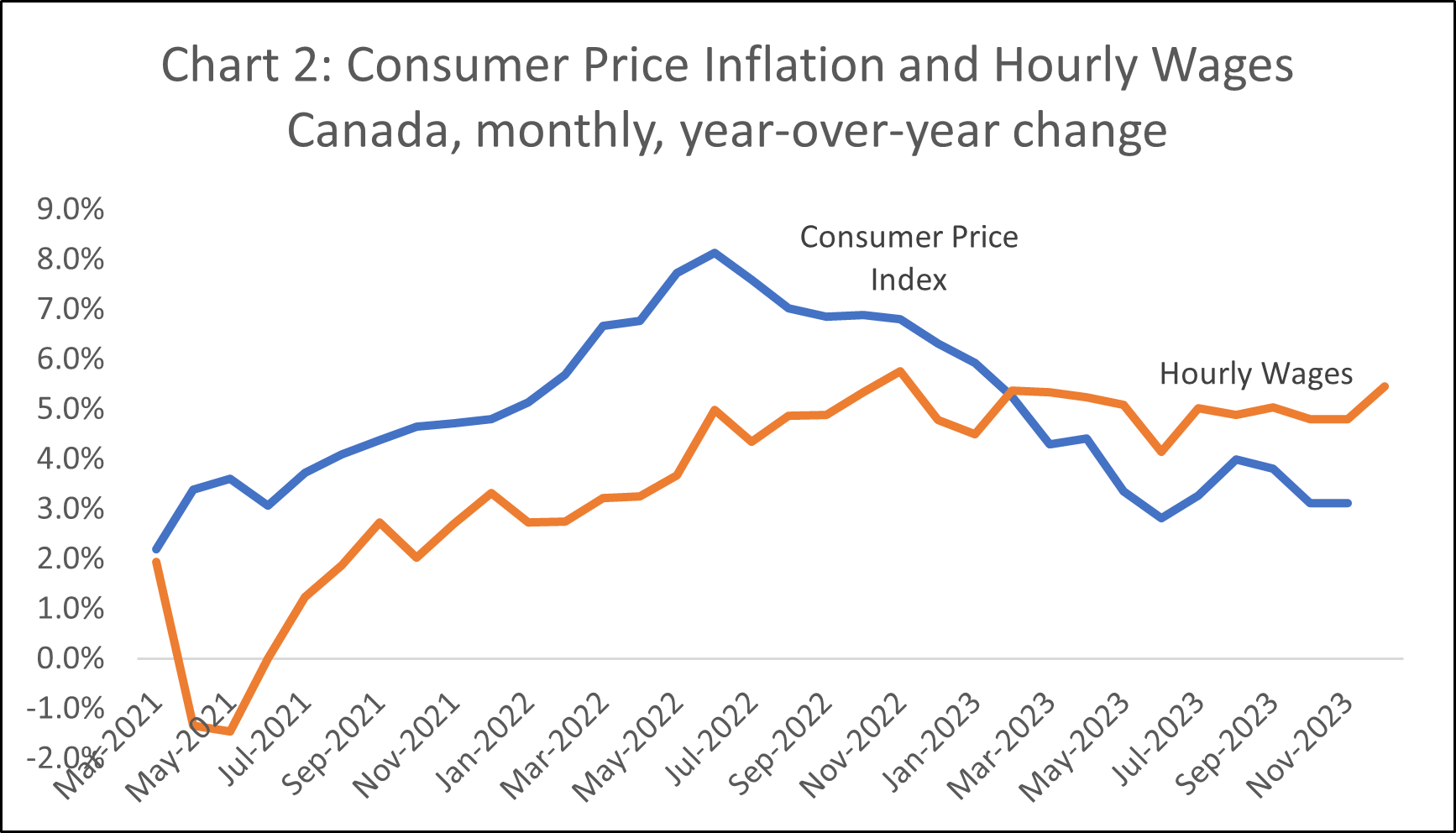

Many economists warn against accelerating wage growth that’s untethered to productivity gains in the economy. Of course, productivity isn’t an easy thing to measure, and it amounts to more than asking workers to simply work longer and harder. In fact, productivity deficiencies (where they exist) typically fall in the lap of businesses who choose to invest, or not invest, in productivity-enhancing technologies – like new, state-of-the-art factories and equipment.

For nearly 15 years, Canada’s manufacturing sector (a key driver of national productivity) struggled with diminishing capital investments. Absent any industrial strategy for Canada under the Harper Conservatives, and following the Financial Crisis of 2008-9, machinery and equipment investment nose-dived.

Today, Canada’s manufacturing sector is resurgent, led by strategic investments of both federal and provincial governments. For instance, and through greater use of industrial strategies, governments have leveraged more than $30 billion in investment to electrify the auto sector supply chain in the past 3 years alone (most of which does not yet appear in national statistics). This is helping turn the tide.

As Chart 3 shows, investment in productivity-enhancing Canadian manufacturing equipment is trending in the right direction, a trend that must continue across all industrial sectors – throughout 2024 and beyond.

#4 The number of union members in Canada’s private sector is growing. Is this a turning point for unions?

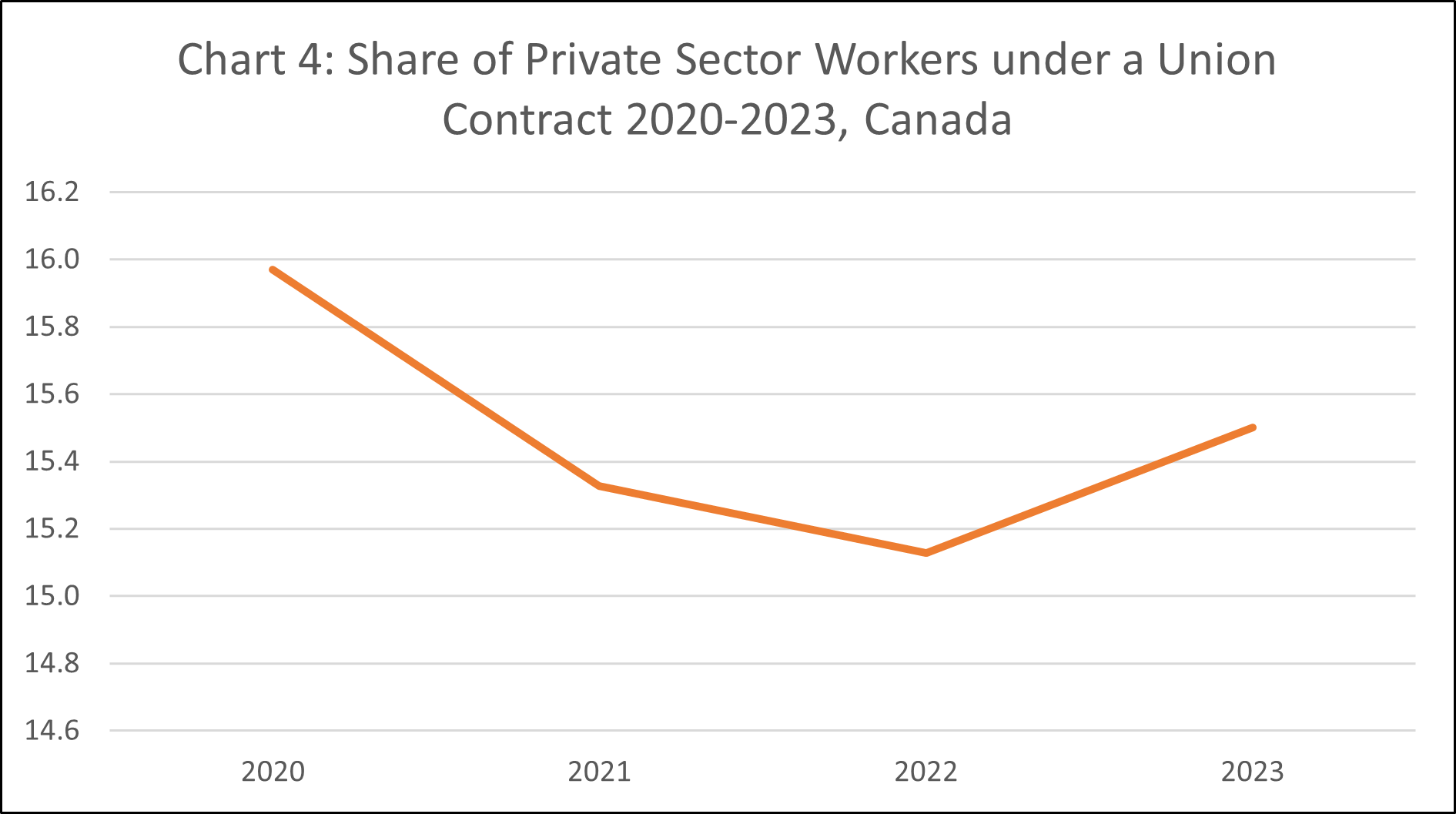

The share of workers in Canada covered by a collective agreement has, for decades, hovered around 30% - or about one-third of the working age population. This figure masks what is a more worrisome decline in the share of union workers in Canada’s private sector, which has fallen from 30% in 1980 to just over 15% today. Most labour laws in Canada make unionizing new workers needlessly complicated and overly burdensome. Many employers fight tooth and nail to keep unions away.

Nevertheless, 2023 saw an uptick in the number of private sector workers joining trade unions – estimated at nearly 178,000 (about the size of the entire city of Regina). Surprisingly, this outpaced the number of new union members in the public sector. So large was private sector union growth that it increased the overall share of Canadian union members to 15.5%, the highest level since 2020, as noted in Chart 4. With provinces like BC having reformed union organizing rules to make it fairer and easier for workers (and others like Manitoba looking to follow suit), this may prove a turning point for workers moving forward into 2024.

#5: Workers showed a willingness to fight in 2023, will that continue into 2024?

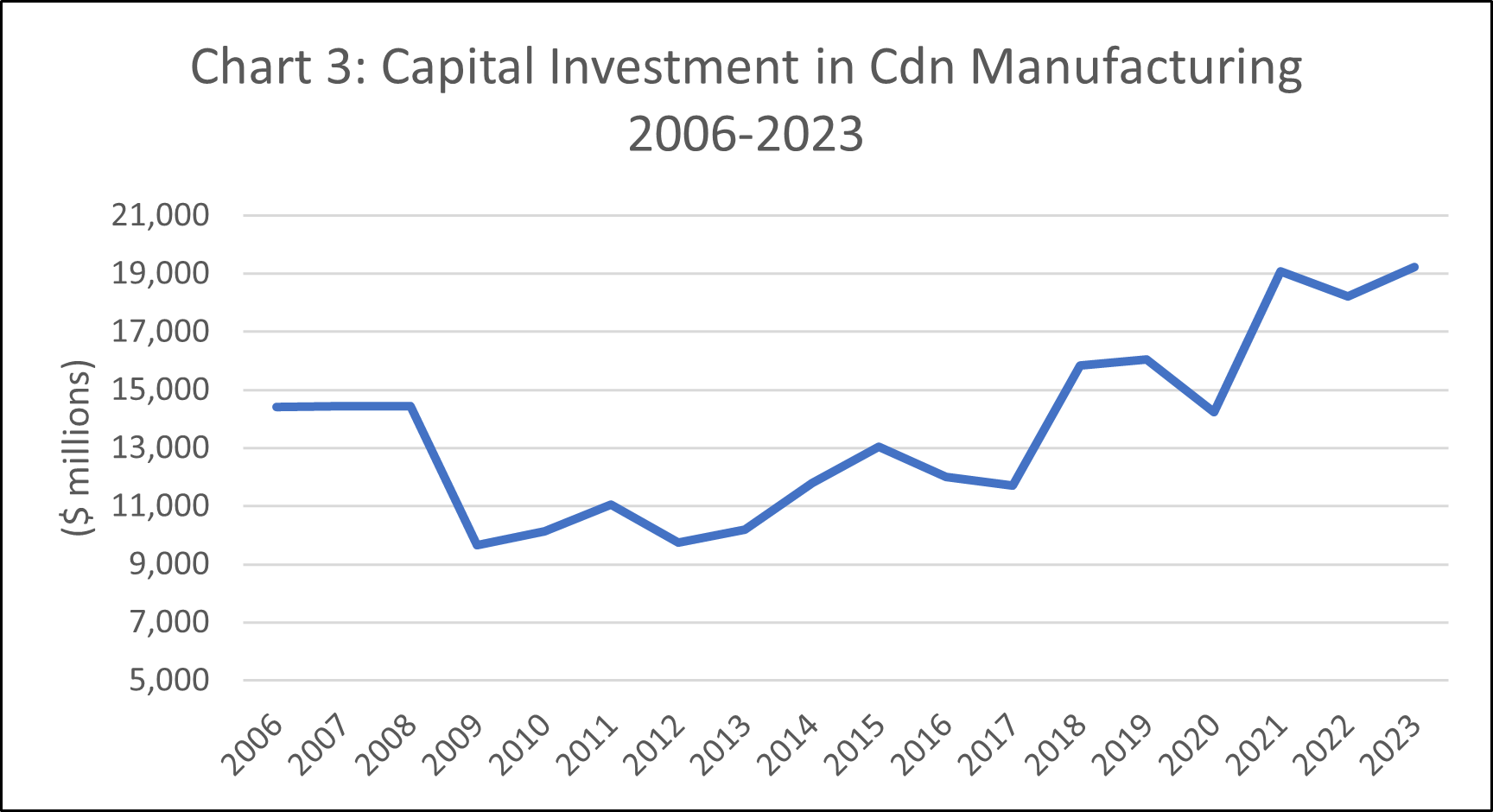

Despite businesses wringing their hands after high-profile labour disputes resulted in big gains for workers in 2023, the truth is that strike incidence remains far less today than in the 1970s (and by many orders of magnitude!).

In fact, as Chart 5 shows, there were fewer strikes and lockouts in 2023 than there were in the years prior to COVID, and comparable to levels witnessed in the 1990s.

Nevertheless, workers who have the right to strike exercised their power effectively and strategically in the past 12 months. This led to substantial contract settlements that raised standards across industries, changing lives.

With major rounds of bargaining scheduled for 2024, including in the hospital, forestry, transport, energy, aerospace and other key sectors, workers will continue to seek major gains, emboldened by the success of 2023.